The End of Old Assumptions: What Publishers Are Prioritizing in 2026

WAN-IFRA Outlook: How publishers worldwide are recalibrating their strategy. Twipe Insights by Sarah Cool-Fergus

Now in its 37th year, the WAN-IFRA World Press Trends Outlook remains one of the most authoritative barometers of the global news industry.

The 2026 edition is based on responses from 172 media leaders across 66 countries and five continents. Nearly half of respondents are C-suite executives, with an even split between commercial directors and executive editors, alongside other senior professionals from across the news ecosystem.

This breadth and seniority make the report particularly valuable as a signal of how publishers worldwide are recalibrating strategy in an increasingly structural, long-term transformation.

1. A sense of optimism in the future

Let’s start with the good news: The latest data reveals that 62.9% of publishers are optimistic about the next 12 months, a figure that rises slightly to 65.2% when looking toward a three-year horizon.

This optimism represents a strategic pivot toward controlling internal variables. Media companies are no longer waiting for tech platforms to “fix” journalism. Rather, they are focusing on their own digital infrastructure and direct audience relationships. By shifting the focus from reacting to external platform shifts to perfecting internal innovation, leaders are finding stability in the eye of the storm.

"In a volatile and often hostile environment, stability achieved through innovation rather than inertia is progress. News media is not standing still – it is adapting with clearer intent, even as the constraints remain real."

François Nel

Editor, WAN-IFRA World Press Trends Outlook

2. The rise of the other revenue

Avertising or subscriptions, that is the question. Or is it?

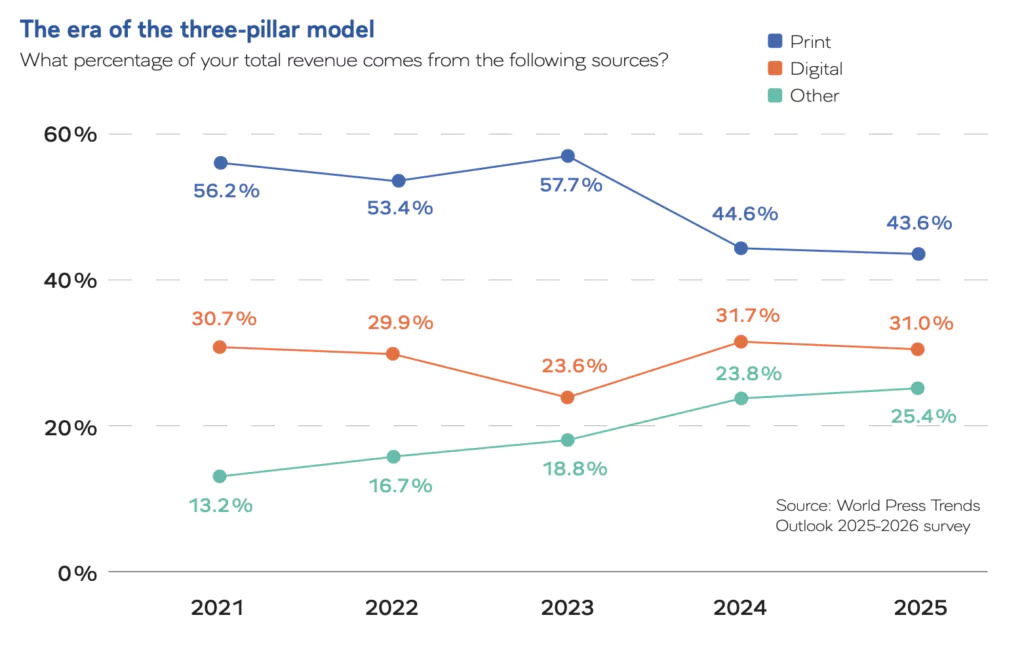

For a decade, the strategic debate in media was a binary choice: advertising or subscriptions. However, the 2026 data suggests that the most successful players are looking well beyond this narrow duo. Diversification has moved from a “nice to have” to a strategic necessity, especially as digital growth has stalled this year, plateauing at 31% of total income compared to 31.6% the previous year.

The most impactful structural shift is the explosion of “Other” revenue sources, which have nearly doubled as a share of total revenue in just four years, moving from 13.2% in 2021 to 25.4% in 2025. This marks the end of the duopoly era and the beginning of a diversified B2B and experiential model.

The top three secondary revenue priorities driving this growth include:

Events (32.2%): A strategy to bypass digital fatigue and secure high-margin sponsorships through physical community gatherings.

B2B Content Services (16.1%): Leveraging newsroom expertise to provide specialized intelligence and agency-style services to corporate clients.

Platform Partnerships (16.1%): Negotiating licensing deals for AI training and discovery.

3. Difficulties in using AI to monetize

When it comes to AI, there is a surprising disparity in adoption. On the one hand, 75.8% of publishers describe their AI usage as either “advanced” or “emergent” when it comes to newsroom workflows. On the other hand, AI maturity is at its weakest in monetization, where 53% of publishers admit their efforts are “nascent” or “seriously lagging.” In short, publishers have become significantly better at making content—efficiently producing summaries, translations, and multi-format snippets—but they are still struggling to use AI to sell it.

The next competitive frontier is not generative text, but Agentic AI and predictive analytics. Success in 2026 belongs to those who use AI to solve the “churn” problem through personalized subscriber retention and intelligent ad targeting.

4. Preparing for Google zero

For decades, the relationship between search engines and publishers was a symbiotic, if tense, bargain. As the BBC famously characterized it: “If the internet is a garden, Google is the Sun that lets the flowers grow.” Today, for many, that sun is setting.

The industry is now bracing for “Google Zero”—a world where AI-mediated search provides answers directly, eliminating the need for a user to click through to a news site. In developed markets, this is a present crisis: 41.9% of publishers are already losing traffic from search engines. This stands in stark contrast to developing markets, where search traffic is still growing as new users come online.

"If the internet is a garden, Google is the Sun that lets the flowers grow"

BBC

To survive when the “Sun” stops shining, newsrooms are building greenhouses. The strategic imperative is a total transition to a Direct-to-Consumer (D2C) model. By utilizing first-party data platforms, publishers can insulate themselves from platform volatility. To thrive, newsrooms must own their audiences through newsletters, proprietary apps, and community platforms.

5. Working with creators

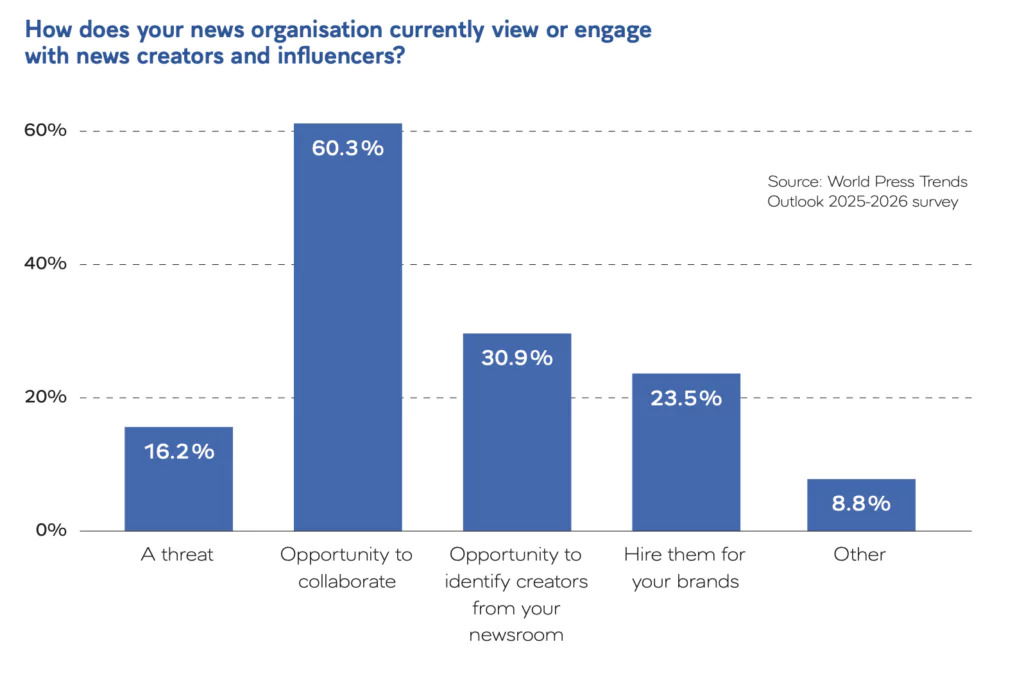

The fragmentation of the attention economy was once seen as the final nail in the coffin for legacy brands. Independent influencers were viewed as competitors for ad dollars. In 2026, that perspective has flipped.

Instead of fighting the creator economy, 60.3% of publishers now view it as an opportunity for collaboration, while 23.5% are hiring creators directly to front their brands. This shift toward “Personality-First Journalism” is the industry’s primary antidote to AI-slop.

The future of media brands relies on being a “supplement” to influencers. Smart publishers are no longer competing for the same 15-second window of attention, but using creators as amplifiers for their deep-dive, verified reporting. By merging the trust of a legacy brand with the reach of a personal brand, publishers are creating a new, hybrid model of authority.

So what?

What emerges is an industry that is becoming more self-directed and more selective. Growth is no longer expected to come from a single channel, a single platform, or a single technological breakthrough. Instead, progress depends on focus: on audiences that can be reached directly, revenue streams that are resilient, and tools that solve real business problems.